When considering making an investment, it's unlikely your first thought would be browsing for a 'classic' car. However, if you're able to net one in good condition – from more modern classics like the 1991 Volkswagen Golf GTI to true icons like the 1968 Ford Mustang – it could actually be a smarter move if you're looking for an asset that'll earn you a few quid in the years to come.

Whilst we might be best known for car leasing, we're car lovers at heart and scoured top lists from industry experts to collate a rundown of the top affordable classic cars – those you could pick up for the average price of a second-hand motor– and find out how much you could make by leaving them to appreciate in the garage.

Before we continue it's important to note that these values (as with all investments) are subject to change and there is always a risk involved. Please make sure you do your research and seek professional financial advice before giving it a go yourself.

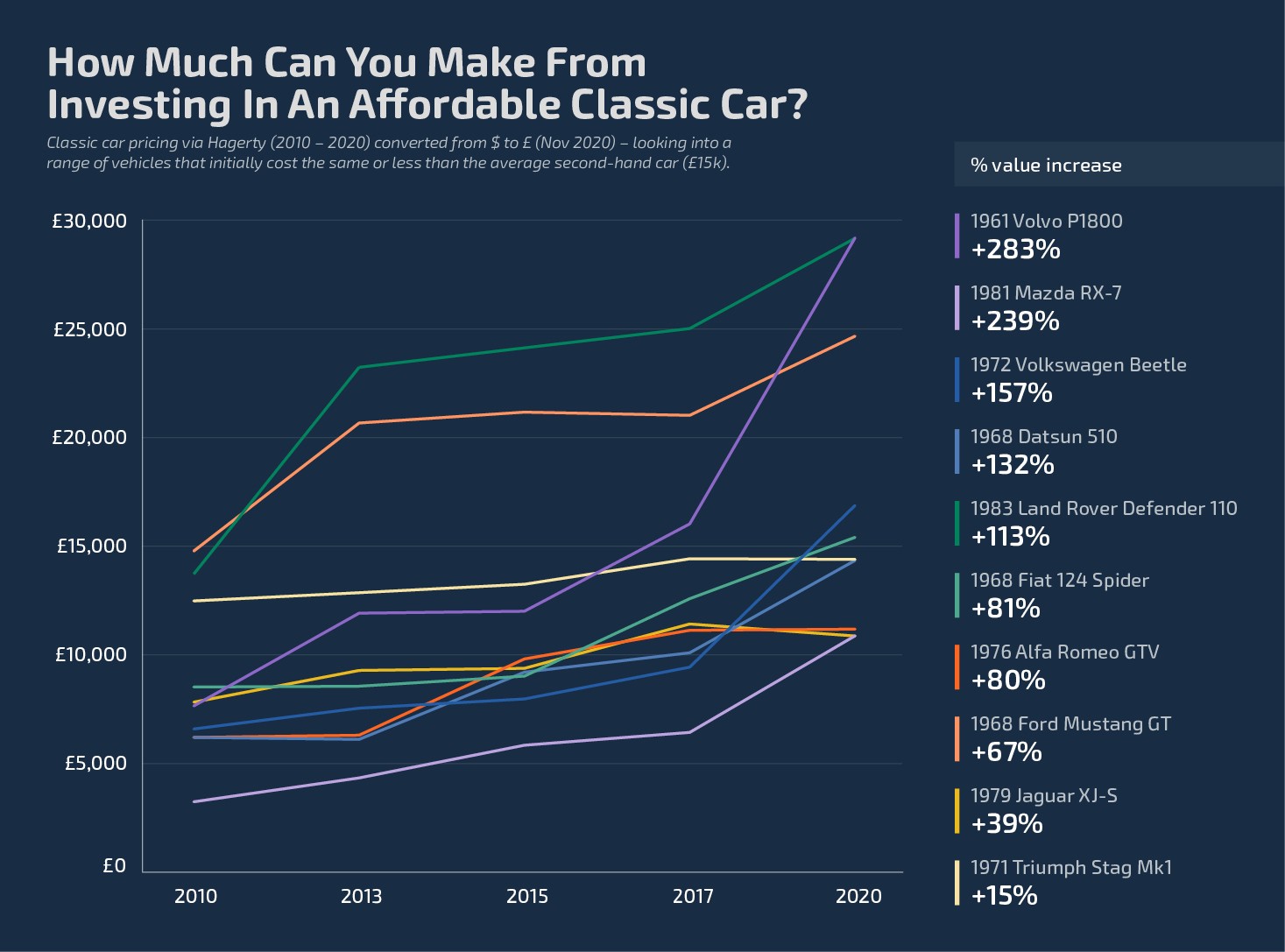

Investing In An Affordable Classic Car Could Net You Over £20,000

With the average second hand car being listed for £15,000 as of mid-2020 according to the NFDA – we set out to find out how much you could make by shelling out that much (or ideally less!) on a classic motor as an investment.

To do this – and illustrate the potential profit to be made – we looked at pricing via Hagerty, spanning 2010-2020 to show how a decade's demand can affect the average cost of a selection of affordable classic cars. Their pricing considers:

● Classic car auctions

● Classic car dealer sales

● Private sales values reported by members

● Values via the UK's top classic car websites

So, they're very thorough! With that in mind, here's how the top 10 stacked up.

Across our study of affordable classics (both more modern and traditional) – the average value increase over a decade was 97%. If that seems like too long to wait, the right car could still add 33% to its value by simply sitting in storage for half that time.

The Volvo P1800 added the most zeroes of the models we researched – with an additional £21,569 on its price tag at auction in 2020 compared to 2010.

Strong performers also included the 1983 Land Rover Defender, adding £15,464 (+113%) and a true classic – the 1972 Volkswagen Beetle – which rose in value by £10,285 (+157%) for those lucky enough to invest in one in 2010.

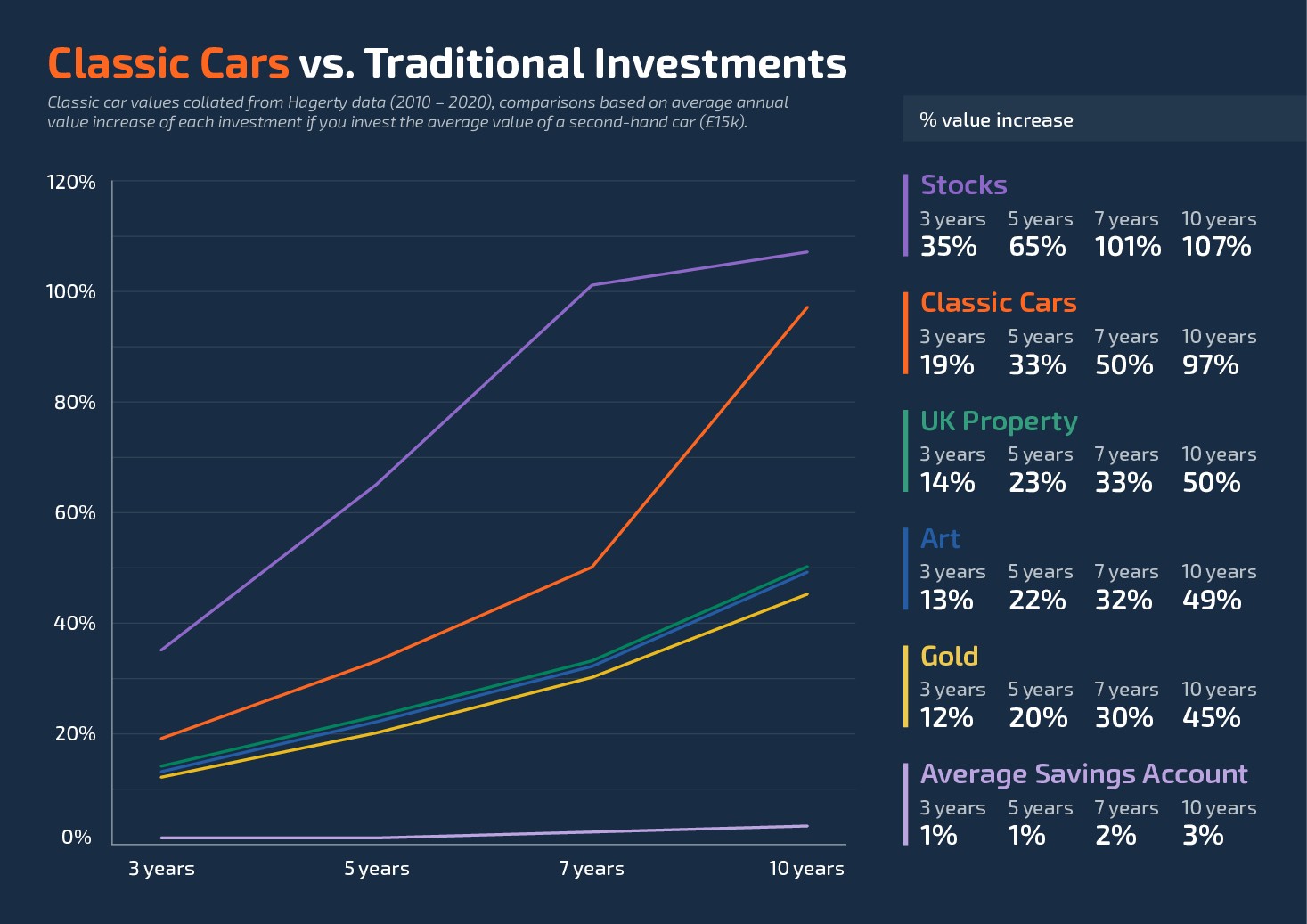

Affordable Classic Cars Can Offer Better Returns Than Traditional Investments

Now that we've looked at how much money you could potentially make if you invest in the right vehicle, it's worth investigating how classic cars stack up alongside more traditional investment methods.

To keep things consistent, we've looked at how the value of commodities like stock, property and art would increase in value if you invested the price of the average second-hand car (£15k). This was also the threshold set for the classic cars in our research.

The top five cars in our research all gained more value over 10 years than traditional investments including precious metals, art, and property. However, to give a more balanced comparison – we averaged the value increase across all the cars in our study.

However, as with the other approaches, it's worth noting that unless you strike it lucky – the best return you're likely to get is if you store the vehicle (making sure to keep it in good nick!) over a longer time.

Tomorrow's Affordable Classics, What to Watch Out For?

Now that you've seen the money-making potential, what do the experts say you should look out for in a soon-to-be modern classic? While there are no guarantees – here are five of the biggest indicators you might be onto a winner:

● Demand – Has the model remained consistently popular beyond when people would usually be on the lookout for the next best thing? This is generally a sign that there's something special and it's worth keeping an eye on.

● **Rarity – **Demand will often lead to scarcity in models that are on their way to joining the ranks of the classics. However, just because they're harder to find doesn't always mean they'll cost more upfront. If you keep out a keen eye for original owners getting rid you could bag a bargain.

● Design – Is it quirky, edgy, or just plain lovely to look at? If so, it's worth keeping an eye on as memorably designed motors are often the best bet when looking at what will be considered a classic.

● **Tech – **Any features or gadgets that were revolutionary at the time or even those that in hindsight were slightly odd can add to the unique appeal of a vehicle and give it more of an edge in whether it will reach 'classic' status.

● Nostalgia – Has the vehicle been around long enough to get a feeling of nostalgia built around it? This is a crucial factor in identifying a future classic – you may have a hunch about a newer model but until it has stood the test of time (say a decade or two) it's less likely to be considered a true 'modern classic'.

One final point to consider is the 'X Factor' - yes, we know it's a bit of a tougher concept to tie down but every classic has that bit of magic that makes it stand out from the pack.

Did the vehicle introduce something game-changing to the market? Was it ground-breaking in functionality? Does it have a fascinating backstory? Was it a limited-edition version of a popular model? If you can answer yes to a few of these, while there are no guarantees, it's a safer bet.

Vanarama's Modern Classic Predictions

We asked our resident YouTube car reviewer Mark Nichol to give his thoughts on what could become the next classic model. Here's what he had to say:

"The BMW 1M Coupe stands out: stunning 3.0 engine, rear-wheel drive, manual gearbox, massive fun, quicker than BMW claimed, and only 450 made. Or there's the Alpine A110: rare and brilliant.

Porsches are always desirable too, so something a bit special like the 2015 model Cayman GT4, only 50 of which made it to the UK, will almost certainly be a good investment.

For something more affordable, the Renaultsport Clio 182 Cup is holding its value well and an original, low mileage example will most likely steadily rise in value."

For skimmers, Mark's predictions for tomorrow's modern classics are:

● BMW 1M Coupe

● Alpine A110

● 2015 Porsche Cayman GT4

● Renaultsport Clio 182 Cup

What do you think about our predictions? Do you have any of your own or some top tips for classic car investments? Why not share them in the comments below or on our social channels.