While there’s much uncertainty over the cost of living in the UK as we near the New Year, car leasing experts Vanarama aims to tackle that and provide some idea of what your car-running costs will be in 2023.

This latest edition of our car insurance study looks at the same 100 job titles to forecast your payments for the next year, whether you drive a petrol, diesel or electric car.

Our Annual Car Insurance Report Now Covers EVs Specifically

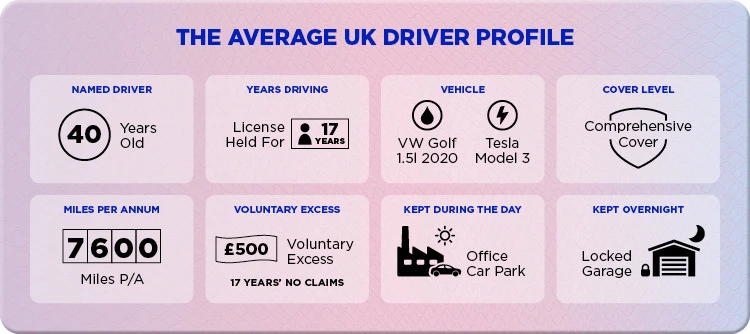

Our 2022 report on the cost of car insurance, forecasting 2023 prices, follows the same methodology used in our 2020 and 2021 editions. To reduce the variables and focus the research on job titles alone, we’ve used the same average driver profile and price comparison site.

All that’s changed is the age of our hypothetical driver and the number of years’ worth of no claims they have – an increase reflecting the time that’s passed since we last ran the results. Well, that and the fact they’re now driving a Tesla Model 3 (the UK’s bestselling EV of 2021 and second-bestselling car of any type) in addition to the Volkswagen Golf. We’ve done this to find out how occupation affects an EV driver, with electric cars becoming an increasingly popular choice.

Hospitality Staff, Social Workers and Sales Assistants Will Pay More For Standard Car Insurance Than Any Other Workers

Those working in hospitality, social care and sales find themselves at the more costly end of the results, but a closer look at the figures suggests it isn’t all bad. Although they’ll pay more for insurance than any other workers in 2023 (£41 per year more than the average), their premiums are still cheaper than they were in last year’s results.

While chefs and bar staff will pay around £2.90 less per year, social workers are set to save a huge £239.66 over the next year – that’s £20 less to pay each month.

Insurance Premiums Have Dropped Since Last Year But Are Much More Than Two Years Ago

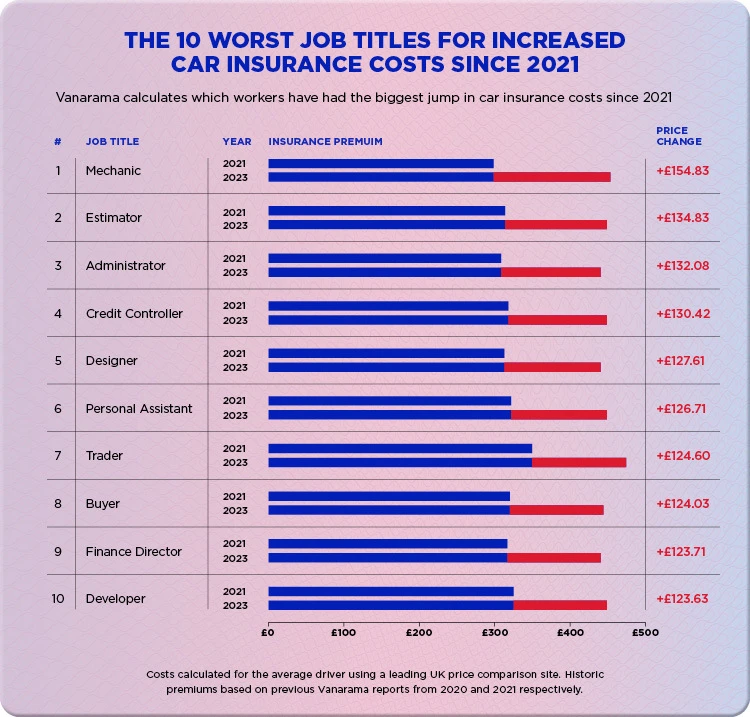

In fact, 64 per cent of workers will spend less on car insurance in 2023 than they did over the past year according to our findings, but comparing with 2021 costs doesn’t return as rosy a picture.

While the average premium for the next year will cost £17.53 less than last year, it’s actually £94.16 more expensive than we paid two years ago – when the cheapest premium was less than £300 (mechanics, £298.61). But since then, mechanics have faced a steeper rise in insurance costs than any other workers, rising by £154.83 to £453.44 per year.

Of the 100 job roles analysed, only those who drive for a living will spend less on car insurance than they did two years (£479.80 down to £421.76).

Management Will Get The Best Car Insurance Deals In 2023

Breaking job role down by level shows we aren’t all feeling the brunt of higher costs. Less than four in ten executives and assistants will get a better deal on renewal compared to their current costs, but nearly nine in ten managers and directors are in for a saving.

Technical managers will benefit from the biggest drop in price, with £77.05 in expected savings on last year, while personal assistants are looking at an increase of £90.31 per year.

We found branch managers, production managers and product managers are due to pay the least overall in 2023, at around £410 per annum. In all, they could save as much as £53.74 a year.

Working In Insurance Doesn’t Get You A Discount

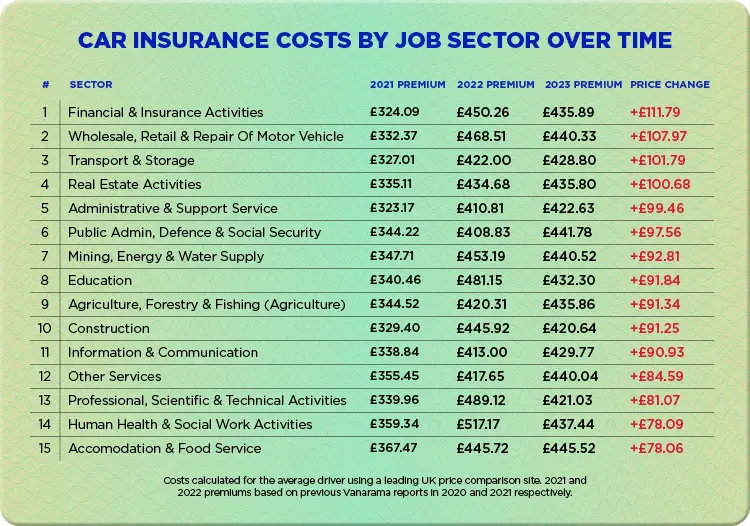

Grouping insurance costs by overall job sector, workers in financial and insurance activities, ironically, will have to fork out £111.79 extra over the coming year compared to two years ago.

By comparison, those in accommodation and food are more than £30 better off, with their insurance costs rising by only £78.06 in the same period.

Health Workers Face The Steepest EV Insurance Bills

Our report finds that no one will pay more to insure an electric car than health workers. GPs, doctors and midwives will pay between £657.52 and £690.88 every year, up to £250.36 more than they’d pay for an equivalent petrol or diesel car. The higher rates could be down to these roles being on-call with unexpected travel required, although that trend isn’t reflected in the petrol and diesel results.

At the cheaper end of the table, marketing execs, operations directors and auditors could save more than £200 per year in comparison, with prices between £437.96 and £441.08 per annum.

Electric Car Drivers Will Be Charged £74 More Per Year Compared To An Equivalent Petrol Or Diesel Motor

On average, our study found that EV drivers will pay £74 more per year for car insurance than if they were driving the average petrol or diesel, a VW Golf. However, with fuel prices yet to come down from their near-£2-per-litre rate, the savings on driving an electric car could narrow the deficit.

Personal Assistants And Firefighters To Find The Best Insurance Rates With An EV

Only two of the roles in our study are actually cheaper to insure with an electric car than they are with a petrol or diesel – personal assistants and firefighters. Although the savings are only £1.86 and £6.31 per year respectively, paired with the potential for real savings on fuel and maintenance, they could make an EV a great choice for these workers.

If you're looking for a new car check our latest car leasing deals if you fancy an upgrade.

Methodology

Following our car insurance reports in 2020 and 2021, this update finds 2023 insurance costs for the same 100 job titles, which were the UK’s most common at the time of researching our first report.

To reduce the variables and focus on the discrepancy in premiums on job title alone, all three reports have been created using the same average driver profile – this is outlined below and covers many factors such as the car being insured, location, relationship status and even where the car is kept at night. The only changes have been the average driver’s age each year and the number of no-claim years.

For 2022, we’ve also added EV-specific insurance costs based on the Tesla Model 3 (the UK’s bestselling EV of 2021 and second-bestselling car of any type) in base spec.

In all cases, the cheapest premium available was taken from MoneySuperMarket for each job title. Data gathered November 2022.

Average Driver Profile

| Usage | Social, domestic, pleasure and commuting (SDPC) |

| Annual mileage | 7,600 |

| Kept in the day | Office or factory car park |

| Kept at night | Locked garage at home |

| Cars kept at household | One |

| Vehicle access | No access to other vehicles |

| DOB | 26/09/1982 - age 40 |

| Relationship status | Married |

| Homeowner | Yes |

| Children under 16 | Yes, one |

| Address | Didcot, Oxfordshire, OX11 7JA (central UK postcode) |

| Employment status | Employed |

| Length of time in UK | Since birth |

| Driving licence | Full licence, UK issued, includes manual vehicles |

| Length of driving licence | 17 - passed age 23 |

| Medical conditions | None |

| Insurance policies declined or cancelled | None |

| Accident claims or losses | None |

| Driving convictions | None |

| Additional drivers | None |

| Registered keeper and legal owner | Yes |

| Cover type | Comprehensive |

| Payment type | Annual |

| Voluntary excess | £500 |

| Years of no claims discount | 17 with this or a previous vehicle |

| Extras e.g. NCD protection, breakdown cover, etc. | None |

| Car (petrol/diesel) | 2017-2020 Volkswagen Golf GT TSI EVO 150, 1498cc petrol, 5-door hatchback, manual |

| Car (electric) | 2019-2022 Tesla Model 3 Standard Range Plus Saloon, electric, 4 doors, automatic |

| Purchased | January 2020 (VW Golf), January 2021 (Tesla Model 3) |