Here at Vanarama, we’ve been doing what we can to shed light on potential upcoming car expenses and provide as much insight as we can to help you begin planning for the new year. Recently we put together a study that aimed to uncover the variations in car insurance quotes depending on job title, which you can read in full here.

In our next study, we’ll be shifting our focus from car insurance to van insurance to see if the variations we discovered in our last study still ring true. We’ll also be switching our attention to the trade sector in particular, due to its size and breadth of skilled individual jobs that fall under that category. And finally, in a similar fashion, we’ll also be outlining the findings when driving an internal combustion engine van versus an electric van to, again, analyse how the price differs.

The Average UK Van Driver Profile

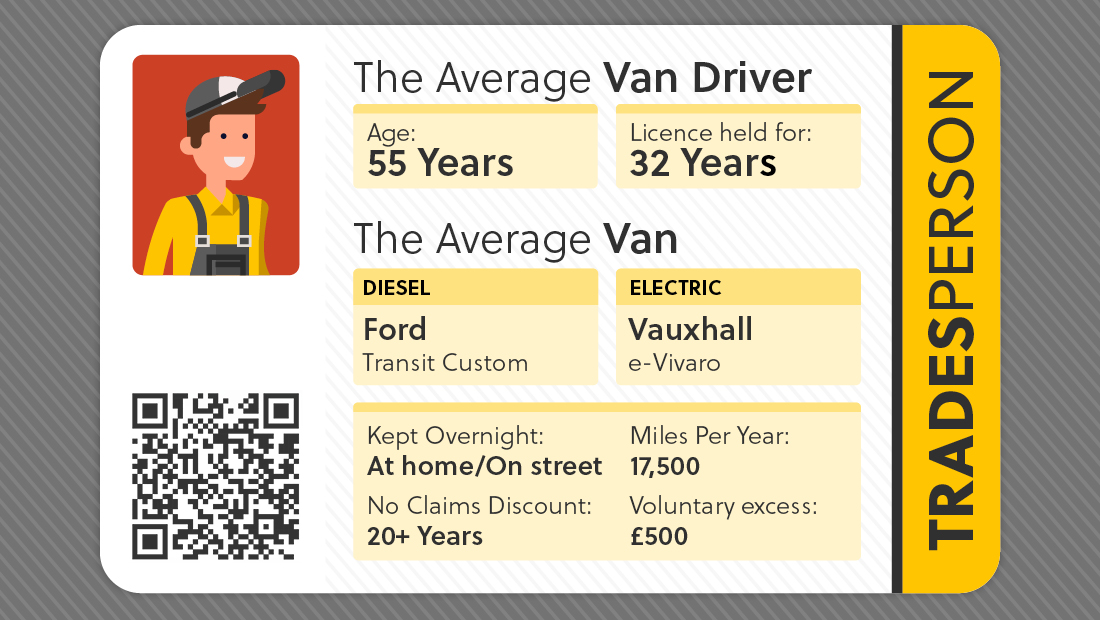

If you’ve read our previous studies, you’ll know that we do whatever we can to make our study as accurate as we can. The main way to do this is to keep as much of the data we input into online insurance forms consistent throughout the study. To do this, we created an average UK van driver profile.

As we’ve already covered, we wanted to show the price differences between driving an ICE van compared to an electric van. This means we need two different vans to conduct our study. For the ICE van, we opted for the UK’s best-selling van, the Ford Transit Custom. The Ford was priced at £14,982, which we came to by scraping and analysing Autotrader listings and taking the average price from all other Ford Transit Custom vans. We also predicted the van would be doing 17,500 miles per annum.

For our electric van, we chose the UK’s best-selling electric van, the Vauxhall Vivaro-e. The Vivaro-e was priced at £21,995, using the same methodology. The mileage per year was also kept the same.

Mechanics Pay The Most To Insure A Van. Full Stop.

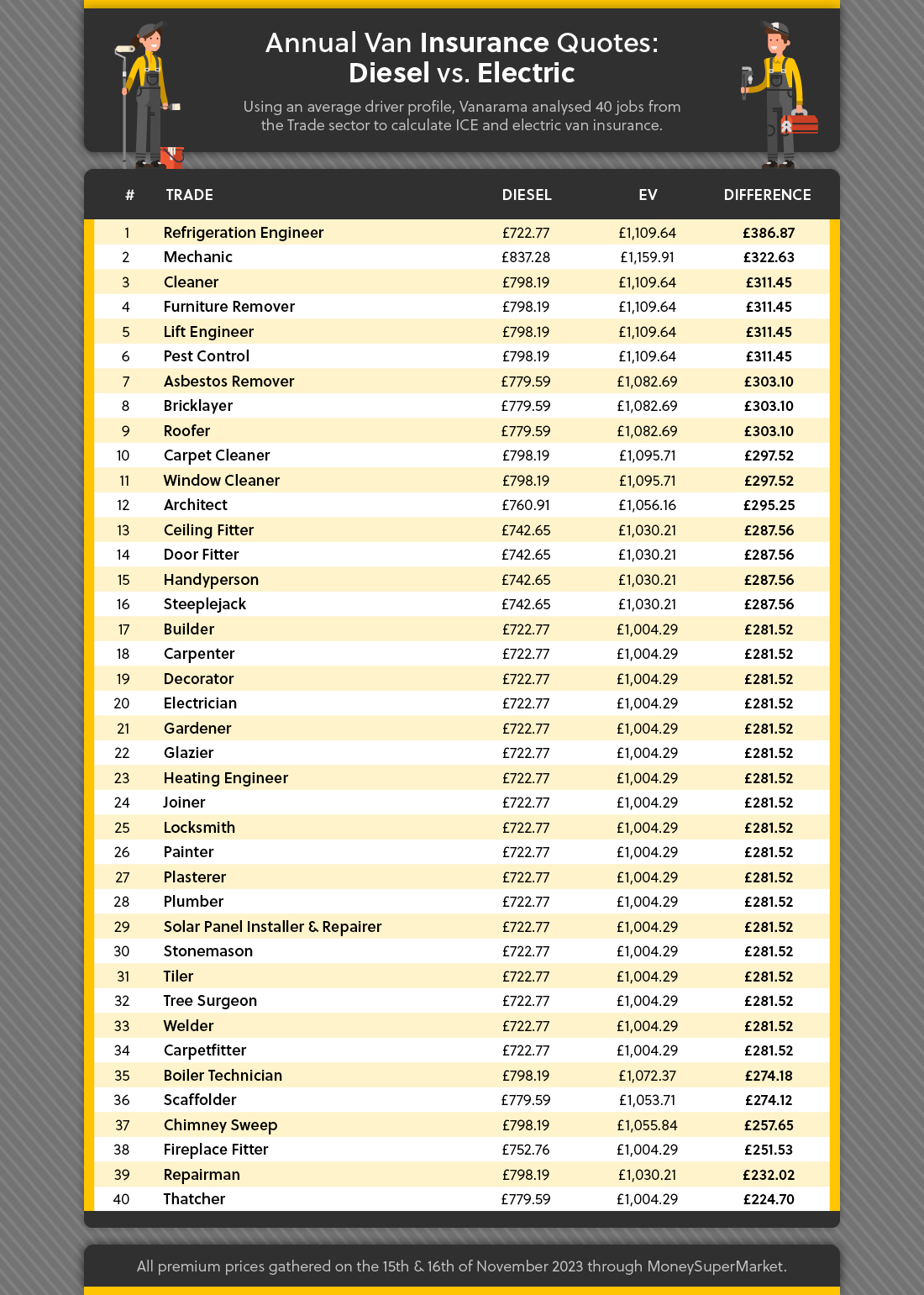

In our analysis of insurance costs for van drivers, our data highlights Mechanics as the demographic facing the highest premiums, regardless of whether they operate ICE vans or the eco-friendly alternative of electric vans.

Our study found that mechanics will receive an annual insurance premium amounting to £837.28 for their diesel vans. This figure not only places mechanics at the top of our leaderboard but they also surpass the second-highest insurance quote by a noteworthy margin of £40 more than the £798.19 quote extended to nine different trades, such as cleaners, pest controllers, and boiler technicians.

Electricians Among Those Who Will Benefit From The Cheapest ICE Van Insurance

In contrast, if we look to the other end of the scale, we find that occupations such as builders, carpenters, electricians, painters, and decorators all receive an annual insurance expense of £722.77. A difference of £114.51, almost 16% (15.8%) less than compared to what mechanics will pay.

When analysing the data, it’s also interesting to discover that so many trades are quoted the same lower price of £722.77. Aside from the aforementioned trades, 14 other trade jobs, including gardeners, joiners and plasterers received an identical quote, totalling 19 overall. This not only sheds light on the financial landscape experienced by different trades but also uncovers the significant variation in premiums based on the nature of the profession and the type of van driven, which continues when investigating insurance costs for electric vans.

Mechanics Pay An Extra £152.62 For Electric Van Insurance Compared To The Lowest Quote

As mentioned earlier, mechanics lead in both ICE van insurance and electric van insurance. Yet, the situation takes a steeper turn for them when it comes to insuring an electric van. Specifically, mechanics face a considerable expense of £1,159.91 to ensure coverage for their electric van over a year.

The challenges for mechanics don't end there. The gap between their costs and the next more expensive quote widens when transitioning to electric van insurance. While, for a diesel van, Mechanics incur a £39.09 difference compared to the next highest quote, the gap extends to £50.27 when it comes to electric vans. £1,109.64, is the next highest quote, which is given to five different trades including furniture removers, lift engineers, and refrigeration engineers.

Trade Professionals Pay A Minimum Of £1,004.29 For Electric Van Insurance

Turning our attention to the lower ranks of the leaderboard we can see that the trades securing the most affordable electric van insurance quotes encompass no more than 20 different job titles.

Among these are those in professions such as stonemasonry, joinery, plumbing, plastering, and locksmithing, to name a handful. However, for these trades, acquiring insurance for their electric vans comes at a cost of £1,004.29, which on one hand is a substantial £155.62 saving in comparison to mechanics, but on the other hand, is still a considerable cost. Also, in comparison to the cheapest diesel van insurance, it is still an increase of £281.52.

Difference Between Driving ICE Vans And Electric Vans Sees Thatchers Win And Refrigeration Engineers Lose

On average our study found that the average diesel van insurance annual premium is £753.39 for the trade occupations we analysed. Compared to £1,040.56 for the average electric van insurance annual premium, which is an increase of £287.17, this could pose a challenge for tradespeople considering going green and making the switch to an EV.

Those working as refrigeration engineers are hit the worst if they opt to drive more eco-friendly. Refrigeration engineers will need to pay £1,109.64 a year if they want to insure an electric van compared to just £722.77 if they were to drive an ICE van instead. A difference of £386.87, the biggest difference for any trade professional.

At the other end of the leaderboard, it turns out that thatchers see the smallest increase when comparing ICE and electric van insurance. Thatchers pay £1,004.29 to insure an electric van per year, joined with other trades such as tree surgeons, glaziers, carpetfitters, tilers etc, but also pay quite a high rate for an ICE van at £779.59, causing a smaller gap of just £224.70. This is a £162.17 difference compared to refrigeration engineers.

Help Keep Insurance Down By Keeping Your Van Safe

Tool theft is on the rise, and has been for a while. The latest statistics show a 62% increase in tool theft between January 2021 and October 2021 alone, with close to 35,000 incidents reported within just those eight months. The report from HertsTools also states that nearly four in every five tradespeople have experienced tool theft. So, it’s more important than ever to do what you can to keep your van and its contents safe and secure. There’s also an additional benefit to keeping your van as safe and secure as possible. Doing so can help reduce your insurance premium!

Vanarama’s Top 5 Tips For Keeping Your Van Safe & Secure

1. Install Advanced Security Features

Installing advanced security features, such as an immobiliser or a tracking device can not only deter thieves but will also provide evidence to your potential insurance provider that your van is at a lower risk of being stolen or broken into, which as a result, can help to reduce the cost you are quoted.

2. Don’t Leave Tools And/Or Valuables In Your Van

When feasible, refrain from keeping tools and valuables in your van during the night. This may be easier said than done in certain situations, but taking tools out overnight serves as a significant deterrent to potential thieves.

3. Remove Ladders And/Or Any Other Equipment Externally Stored

If you have any external equipment, like ladders attached to your vehicle, take them off or ensure they are empty before leaving your van overnight. This may be a hassle if space is limited at home, for example, but the effort is worthwhile for the reassurance that your belongings are safe and secure.

4. Park In A Safe Location Wherever Possible

The optimal places for parking your van include outside your residence, preferably on your driveway, or better yet, within a garage. If street parking is necessary, opt for well-lit areas. You can also take extra measures to make sure your van is safe when parking on the street. Investing in CCTV cameras to surveil your van overnight is an option but can be pricey. Other solutions could include fake cameras, which act as effective deterrents or perhaps installing motion-detecting lights positioned outside your home.

5. Mark Your Tools And Equipment With A UV Pen

In the unfortunate event of a break-in and theft of tools or equipment from your van, it might not be the end of the road for their recovery. By using a UV pen to mark all significant and valuable items, you enhance the chances of retrieval. When reporting the theft to the police, the markings can serve as identifying features, enabling law enforcement to potentially track down and recognise your belongings.

For more information about how you can secure your van, we also have an in-depth guide available in our blog. If you’re a tradesperson interested in a new van you can check out our great value van leasing deals.

Methodology

Following our car insurance reports in 2020, 2021, 2022 and 2023 this update switches its focus to van insurance, with a specific focus on the trade industry. We selected 56 of the most common trades, reducing the number down to a core 40 as some trades would not require their own van for self-employment purposes.

To reduce the variables and focus on the discrepancy in premiums on job title alone, our report has been created using an average van driver profile.

In all cases, the cheapest premium available was taken from MoneySuperMarket for each job title. Data gathered November 2023.